Formerly WebStrategies, Inc.

How Often Do People Use AI to Find A Bank or Credit Union?

Chris Leone

Dec 1, 2025

AI tools like ChatGPT, Claude, and Gemini have changed the way people find information online. But the actual impact these large language model tools (LLMs) are having on businesses is still unclear. Credit unions in particular are left wondering where and how these AI tools factor into the member experience.

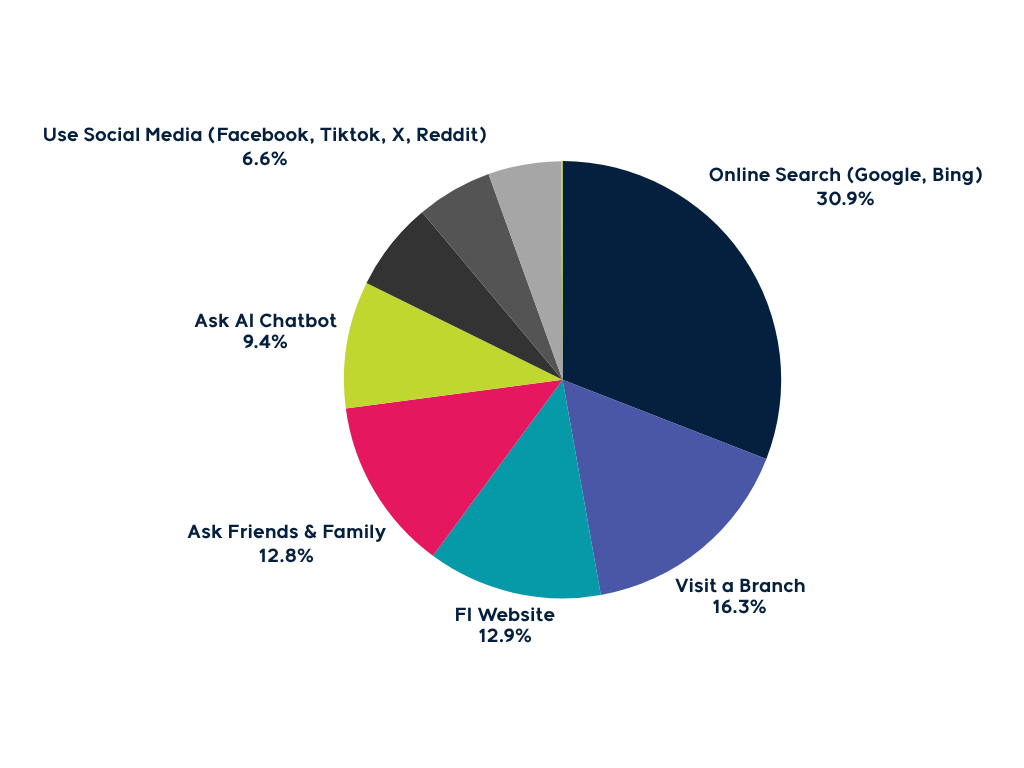

In a recently published survey conducted by Geear of 1,000 consumers, we found that people turn to LLMs as their first step when looking for an FI nearly 10% of the time. By comparison, search engines are used first ~30% of the time.

Search engines have long been considered the #1 way to be found, for nearly every industry, including FIs. And while that’s still true, AI tools are a meaningful disruptor in how people find businesses.

Prior to our study, the frequency with which people were using LLMs for FI research was not readily available. ChatGPT usage in particular has grown substantially, but its specific impact on FIs was unclear.

In addition to our study, we analyzed 50 credit union websites to determine how much of their traffic was driven by ChatGPT. Our results found LLMs represented only 0.1% of total LLM + search combined traffic. In other words, if you only look at traffic referrals as an indication of how disruptive LLM are for you, you’d conclude it’s not worth the time.

But unlike search engines, LLMs are more of a branding channel versus a performance channel. In other words, since LLMs are not designed to link people away, the way we measure their impact and value is different than that of a search engine. When measuring the impact of search engines on a CU or bank website, we can look at traffic from search engines and the action taken by those visitors. Since LLMs are more of a branding channel, we might measure the frequency a particular CU or bank is cited in an LLMs response or the lift in branded/direct traffic to a website.

What does this mean for CUs?

If you’ve been investing in producing high-quality content on your website and ensuring you have a reputable brand online, you're off to a good start. These are all positive signals to LLMs (although the impact will vary depending on the LLM).

That said, there are still some nuances between optimizing for search engines and optimizing for LLMs. In addition to high quality content and a good online reputation, here are some other tactics that can help with your citations:

-

Eliminating 499 statuses on your webpages - since LLMs may access your website in real time versus pulling from an index (as search engines do), a 499 code basically says your site is taking too long to load and will no longer be considered in the LLM's response

-

Writing longer, more descriptive URLs - these act as a signal describing what the page is about.

- Writing strong meta descriptions - search engines stopped relying on meta descriptions many, many years ago, but LLMs use them to determine if a page should be fetched and used in its answer.

- Strong brand authority online, built through digital PR and presence on social media, local, or industry websites.

How Can Credit Unions and Banks Track Their Visibility in LLMs?

Tracking your presence on LLMs comes with several caveats. First, new research is showing that LLM responses vary wildly for each individual. In some cases, you'd have to run a prompt hundreds or thousands of times to get the same recommendations in the same order. So just because your brand shows 1st or 4th or 7th doesn't mean others see the same. However, there is statistical validity to tracking your brand's overall presence. In other words, while position/ranking inside an LLM response is fairly random, whether or not you show is not considered random.

Tools like GumShoe and Profound will ping various LLMs with pre-set prompts and track your brand’s visibility over time. This is a good start for beginning your GEO/AEO journey and understanding if your efforts are having an impact.

Ready for marketing that actually delivers?

Let's build something measurable together.

Talk to the Team

Talk to the Team